Warning: Are you making the #1 financial mistake?

I Escaped the Paycheck Trap by Converting My Income into Self-Sustaining Assets

Now You Can Use the Exact 7-Part Wealth Transfer System to Protect Your Paycheck From Inflation and Build Income That Grows on Its Own.

"I Thought I Was Doing Everything Right—But My Paycheck Was Losing Value Every Month."

"I was working full-time, saving what I could, and still felt like I was falling behind. Groceries, rent—everything got more expensive while my paycheck stayed the same. I didn’t realize how much money I was losing until I started using this system. Now, instead of watching my income shrink, I’ve got extra money coming in every month—without working more." - James R., Retail Manager

JUST $27 NOW - PRICE GOING UP SOON!

AS SEEN ON

Why Your Hard-Earned Money Is Losing Value Faster Than You Think

The financial system is rigged against you - here's ho to take back control

Escape The Inflation Trap, Build Real Assets, and Replace Your Paycheck With Passive Income – Without Wasting Another Year

If you’re working harder than ever but feel like you’re getting nowhere, it’s not your fault. The financial system was never designed to make you wealthy—it was designed to keep you dependent on your paycheck.

Inflation is rising faster than wages. Savings accounts pay less than 1% while inflation eats away at 6-8% of your purchasing power. Cutting expenses won’t help when the price of everything keeps going up. If your money isn’t making money, you’re falling behind.

the harsh reality:

The dollar has lost over 20% of its value in just the last 5 years.

Savings accounts don’t protect you—they’re losing value every day.

A single income stream isn’t enough—true security comes from owning assets that pay you.

Why Traditional Financial Advice Keeps You Stuck

The “Save More, Spend Less” Lie – And What Actually Works

For decades, financial gurus have preached the same outdated advice:

But no one gets rich from budgeting alone. You don’t need to “cut back” or live with financial stress—you need a new system that actually builds wealth.

The truth is, high earners struggle just as much as low earners—because they’re still trapped in the cycle of working for money instead of making money work for them.

Savings Alone Won’t Save You

Banks pay you 0.5% interest, while inflation devalues your money by 6-8% a year. That’s a guaranteed loss.

Traditional Jobs Are Financially Fragile

62% of Americans couldn’t cover a $1,000 emergency without debt. Relying on one paycheck is a high-risk strategy.

Debt Is Designed To Keep You Trapped

You pay 20%+ interest on credit cards, but banks pay you less than 1% on savings. They profit while you lose.

The solution? ownership.

Build wealth by acquiring income-producing assets, creating passive income streams that pay you monthly, and following a proven system designed for long-term financial independence.

The Only System That Transforms Your Paycheck Into Wealth-Building Assets

Stop Trading Hours for Dollars – Build a Financial System That Pays You Even When You’re Not Working

Instead of constantly worrying about bills and wondering if your paycheck will stretch far enough, this plan shows you exactly how to build assets that generate stable, recurring income—so you have financial security that grows every month.

Step One:

The Asset Acceleration Formula

Automate wealth growth by directing income into high-value assets before you spend a dime.

Step Two:

The Paycheck Independence Roadmap

Use the Smart Capital Deployment Strategy to eliminate bad debt while building wealth at the same time.

Step Three:

The Passive Income Expansion Plan

Multiply your income streams strategically until you replace your paycheck with self-sustaining assets.

This is how you create financial stability, eliminate dependency on one job, and generate wealth that grows even when you're not working.

Why Traditional Money Advice is Keeping You Broke

The Wealth Gap is Growing – Here’s How to Avoid Getting Left Behind

Before / Old Way

One Source, No Control: Depending on a single paycheck leaves you financially exposed—if it stops, so does your income.

Savings That Shrink Instead of Grow: Inflation erodes your money while banks give you next to nothing in return.

Always Trading Time for Money: No income-generating assets mean you have to keep working just to stay afloat.

Your Paycheck Loses Value Daily: Rising costs outpace wages, keeping you in survival mode no matter how hard you work.

After / New Way

Predictable, Recurring Income: Set up multiple revenue streams that continue paying you—whether you work or not.

Your Money Grows Automatically: Shift your earnings into assets that generate income, compounding your wealth over time

Wealth That Builds on Itself: Each decision moves you further from paycheck dependency and closer to financial independence.

Financial Security That Lasts: Create a system where your income covers your needs—without worrying about the next paycheck.

The Missing Wealth the 1% Don’t Want You to Know

The Wealth Transfer System That Converts Your Paycheck into Long-Term Financial Security

The Paycheck Replacement Plan

A Research-Backed Approach to Turning Your Paycheck Into a Self-Sustaining Income Stream

"I started earning extra income without quitting my job or working more hours."

"I always thought building wealth meant taking big risks or starting a side hustle that drained my time. But this system showed me how to create passive income streams while keeping my 9-to-5. Now, I have money coming in every month, and the transition to financial freedom feels real—and doable." — Lisa M., Healthcare Administrator

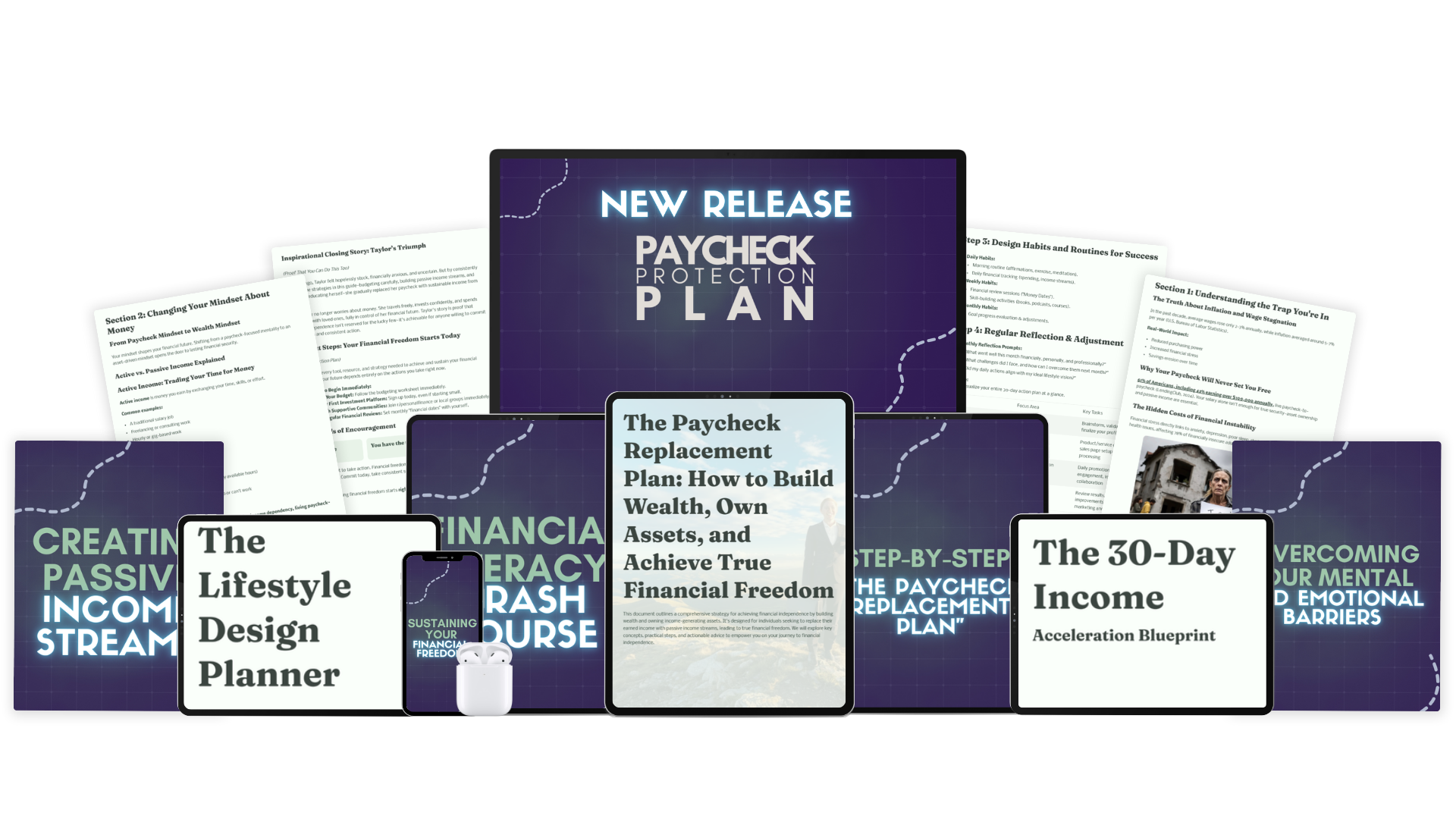

Everything You Need to Build Wealth Like the Top 1%:

The Wealth-Building Acceleration Guide – A 65+ page blueprint breaking down how to grow your net worth systematically.

The Asset Acquisition Playbook – Learn how to secure income-producing assets with step-by-step strategies.

The Paycheck-to-Ownership Formula – A complete, actionable framework for transitioning from a single paycheck to multiple income streams.

The Emergency Fund Fast-Track System – Get financially secure faster with an accelerated money protection plan.

The Strategic Debt Payoff Guide – Cut high-interest debt efficiently while redirecting money into assets that build long-term wealth.

The Monthly Freedom Tracker – A customized system to track your financial progress and milestones.

BONUS #1: The 30-Day Income Acceleration Blueprint – A step-by-step income growth plan to start generating additional revenue in just 30 days.

BONUS #2: The Lifestyle Design Planner – A guide to structuring your financial life for long-term freedom and flexibility.

Price going up soon to: $197

Today just $27

JUST $27 NOW - PRICE GOING UP SOON!

The Missing Wealth the 1% Don’t Want You to Know

What Others Have Achieved with This Plan – And How You Can Too

This works for hundreds of others and can work for you too.

"I Went From $50 Left After Bills to Real Savings"

"Every month, I had less than $50 left after bills. Now, I have extra money stacking up, and I finally feel like I’m getting ahead." — Mark T., Warehouse Supervisor

"I Grew My First $5,000 in Savings Without Cutting Back"

"I never had more than a few hundred dollars in savings, and I was always nervous about unexpected expenses. Now, I’ve built my first $5,000 in savings—and I didn’t have to sacrifice everything to do it." — Sarah M., Single Mom & Office Assistant

"I’m No Longer Stuck Working Just to Get By"

"No matter how much overtime I worked, it never felt like enough. Now, I wake up knowing I have money coming in whether I clock in or not." — James P., Truck Driver

"I Finally Feel Secure No Matter What Happens With My Job"

"For the first time, I don’t have to panic if an unexpected bill comes up. My finances feel stable, and that peace of mind is priceless." — Lisa R., Teacher & Side Business Owner

The Real Cost of Waiting

Your Financial Growth is Our Commitment

Why we stand behind The Paycheck Replacement Plan with a Success Assurance Commitment

How it works

We believe in real financial progress, not empty promises. That’s why we back The Paycheck Replacement Plan with our Success Assurance Commitment—follow the steps, take action, and if you don’t see measurable financial improvement within 60 days, we’ll provide additional resources, strategy refinements, and

Simply email us at hello@paycheckprotectionplan.com with "paycheck" in the subject line, and we'll process your request within 24 hours.

SUB-HEADLINE TEMPLATE IPSUM

Who’s the Flexible platform for?

Lorem ipsum dolor sit amet consectetur, cras urna tortor ipsum velit quis elit.

Perfect for those who:

People who take action now are already watching their financial security grow—while those who wait are falling further behind. This system gives you the exact steps to build assets, automate income, and escape the paycheck trap before it’s too late and you're facing the costs of ...

One: Stay at home parents

Lorem ipsum dolor sit amet consectetur, cras urna tortor ipsum velit quis elit.

Two: Busy professionals

Lorem ipsum dolor sit amet consectetur, cras urna tortor ipsum velit quis elit.

Three: Entrepreneurs & CEO's

Lorem ipsum dolor sit amet consectetur, cras urna tortor ipsum velit quis elit.

Everything You May Be Asking Yourself Before You Get Started

I’m barely making ends meet—how can I afford to invest in this?

We get it—every dollar counts. This plan is built for people who are stretched thin, helping you find hidden income, redirect spending smartly, and start growing wealth with little to no extra money upfront.

How long does it take before I start making more money?

Many people start seeing results within a few weeks—like saving more automatically or earning their first extra $100-$500 per month. Bigger financial shifts, like replacing your paycheck, typically take 6-12 months, depending on your starting point.*

I don’t know anything about investing—will this be too complicated?

No jargon, no confusing charts—just a clear roadmap designed for beginners. Even if you’ve never invested before, this plan shows you exactly where to start and how to make your money work for you.

I don’t have extra money right now—how can I make this work?

This system helps you find overlooked money, eliminate wasteful spending, and redirect funds into wealth-building—without needing a big upfront investment.

Copyrights by Paycheck Protection Plan™ 2025| Terms & Conditions